A loan is not a gift

June 27th, 2018

I think we have all been in this situation sometimes, where we really want to do something important but lack the money to do so.

You try to earn the money or borrow it from a relative or friend, but if all else fails you can take out a loan.

We are making online teaching materials on financial literacy, so I recently had the opportunity to interview some people about taking out a loan. Most of the people I talked to were members of savings and credit co-operatives (SACCO). One of the stories I found most impressive was that of a woman who told me, “I used to sell a few things from a basket, but I was not developing. I was still relying on my husband’s income. I decided to take a loan from the Tinyuka Wigire Munyarwandakazi programme from SACCO. Now I have my own stock.” The Tinyuka Wigire Munyarwandakazi programme is a government fund allowing poor women to take small loans without collateral.

Can everyone get a loan?

Now you might be thinking that if a poor woman with no collateral can get a loan, anyone can. But it’s slightly more complicated than that. Jean Bosco Nshimiyimana, a loan manager with Umutuzo SACCO, explained the requirements to me.

“To get a loan from our SACCO, you have to be a member with an active account. You bring your project along with a photocopy of your identification card, a photocopy of your guarantor’s identification card, your marital status certificate and your land certificate as collateral.”

So, if you were thinking of running away with their money, think again! They have all your information. You really have to pay it back.

I also asked people what they considered important in being able to pay back a loan. The three most mentioned points were:

- Use your loan for the purpose for which it was applied for

- Work hard to make sure you pay your instalments on time

- Share all information with your spouse and make a joint plan

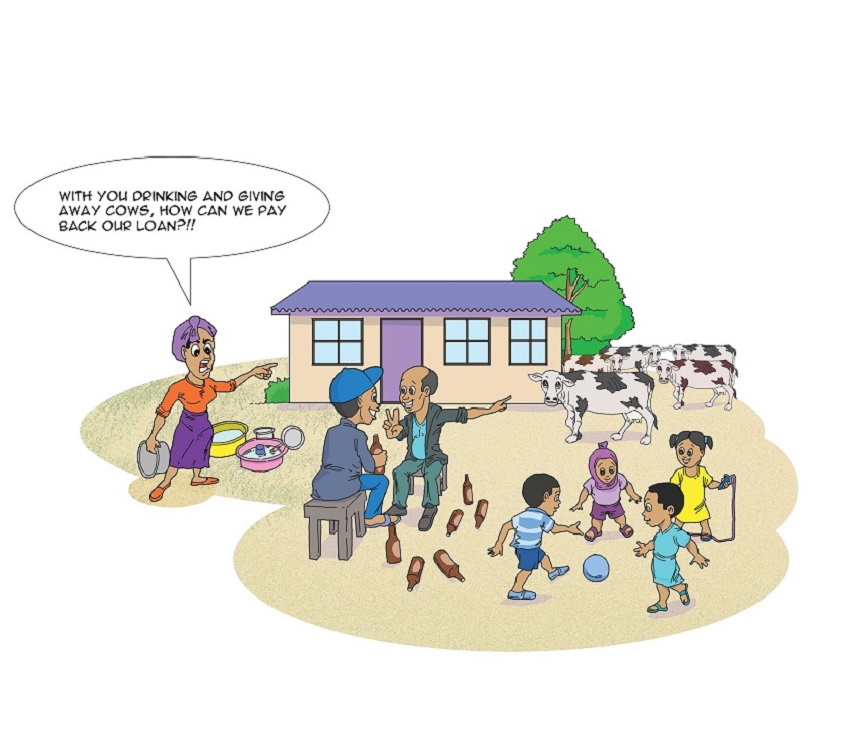

The first two seem quite obvious to me, although we all know stories of people using credit for consumptive purposes, leaving them unable to pay back their loans. I like the third reason best. Financial literacy training successfully pushes the gender perspective.

What happens when you face the unexpected?

One person told me, “Too much rain washed away all my potatoes. I wrote to SACCO explaining what happened and asking for an extension of the repayment period. It was granted.”

Nshimiyimana confirmed that SACCO tries to help people with repayment issues.

“We don’t want to lose our members, we want them to develop. If a member fails to pay on time, we can extend the repayment period or we can give an additional loan,” he explained. “However, when we discover that people lied to us and the loan has been used for other things, we ask for our money back and even sell the collateral.”

Final remarks

During our project on gender in agriculture, we made images of women in finance. These images help those who deliver training in financial literacy. You can click here to see those images. We hope that you will use these materials. Thanks, and we look forward to hearing from you.

Nehemie Nkurunziza